Tax Blogs - Part I

The Tax Shuffle: Organize Your Tax Documents Now for Later

by Lydia Barnes

As artists, we don’t like thinking about taxes. They aren’t intriguing. They have no fascination. They are merely a necessary evil that comes at the beginning of the year when the weather is foul, and our pockets are suffering from the holidays.

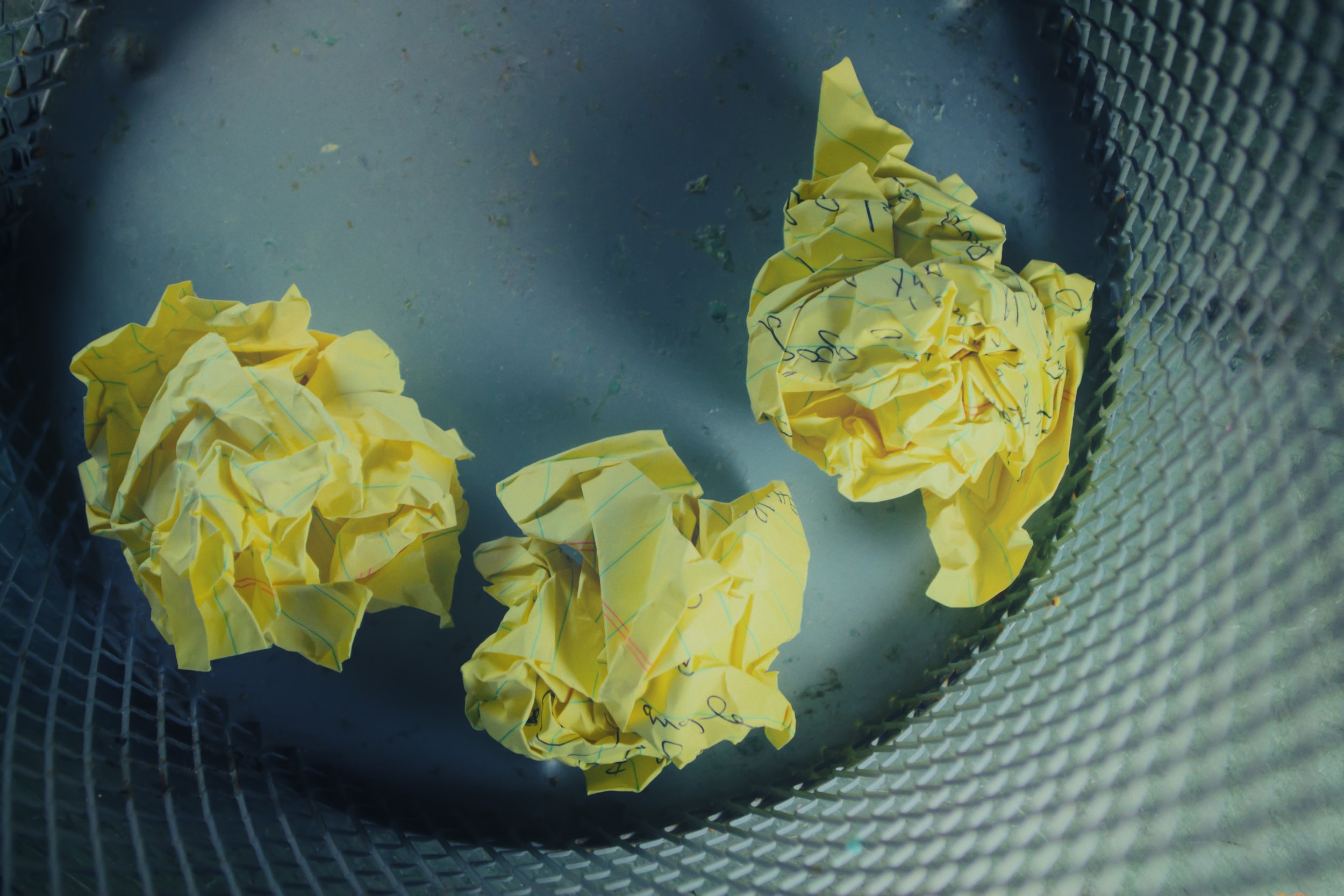

So why should we not just toss our financial information at someone else and forget about it?

I’ll tell you why. One, that someone may not be familiar with what you do to earn your money. Two, they may not know how to maximize your expenses to minimize your reportable earnings. These two together can make you pay more than you should to the IRS.

So, how do we avoid the pitfalls of being an artist when taxes roll around?

Preparation and consistency are the key. Let’s discuss what you need to do all year long.

Expenses - Nothing is worse than spending a weekend digging through purses, pockets, briefcases, desk drawers and the bottom of closets looking for all of last year’s expenses. You need to separate your expenses into two categories – business and personal. To do that effectively, you need to do it when they occur. Making note of what happened saves lots of brain power and money.

You need a place to keep your expense documents, which are receipts for supplies, travel expenses, travel food, equipment, costumes, bills invoices for services rendered, memberships, space rentals and postage. My suggestions depend upon how much of these things you generate. If you are busy every month and you buy things, then you may need a plastic shoe box for each month or an accordion file with at least twelve pockets. If you don’t generate a lot of paper, twelve large envelopes or file pockets may suffice.

At the end of the year, you may want to go through these documents and categorize and tally them up. Your tax person can do it for you, but unless they give you a flat rate fee, they will charge you for every hour they spend. A couple hundred dollars can balloon very quickly to near a thousand if you let it.

Earnings – Again, looking for all the check stubs— to make sure you have all the 1099’s to go with jobs that you did during the year — can be as painful as looking for expenses. These should be put into one large envelope as you receive them. IF you do not include all the ones that have been reported to the IRS, they will make adjustments to your earnings, giving you no opportunity to mitigate those earnings with the expenses that are attached to them. That means you will be paying more money to the IRS.

If you are a late bloomer who has done none of these things throughout the year, you may be in for a hunt for the appropriate documents, but the organization tips I shared still stand as effective. So get busy and after you turn in your taxes— before or by April 15, 2025 (a Tuesday)--- get those shoe boxes or accordion files ready in preparation for next year.

________________________________

Tax Blogs - Part II

Picking a Tax Preparer for an Artist

by Lydia Barnes

The average person can walk into any tax preparation place, sit at a desk and be pretty sure that their taxes will be properly prepared. But writers, artists and performing artists have concerns that need to be addressed by tax preparers who are familiar with small business taxes.

As artists, we can include our earnings on our personal taxes by using the same tax schedule as a small businessperson because the IRS has made the Form Schedule C, flexible enough to cover businesses earning under $10 million. The same goes for LLC’s.

In a CPA or Tax office, you need to ask if the person preparing your return is familiar with doing Schedule C’s and how long they have been doing them. If you are familiar with what has been done in the past for your return, you could risk someone with a year of experience, but unless they tell you they have the help of a senior preparer, you might want to reconsider. SHOULD they bristle at answering this question, find another place. Also ask if they have done any performers, artists or writers. It does really make a difference.

You also need to know how you will be charged, by the hour, by the form or as a flat rate. You need to know in advance approximately what you will owe them.

In the offices of the big three preparation companies, there is usually a senior preparer who gets all the “complex” returns. That person may or may not be there every day, so there may be a delay in getting your return done, however, if it takes more than a week, go get your information back and seek another place.

Also, you may have to come back at a specific time to meet them and have them work on your information face to face. If so, be prepared for a couple of hours minimum.

Lastly, the better organized you have your information, the quicker the preparation will be. Don’t be shy about adding up your stuff yourself because if you have made a mistake, the tax software may catch your error.